Follow Us:

Anjan Ghosh

Principal Broker

About Anjan Ghosh

Anjan Ghosh has a decade of expertise as a seasoned mortgage professional. He has extensive

expertise in residential and commercial mortgages and has assisted clients from throughout

Canada in obtaining funding for purchasing properties. Anjan has extensive knowledge of the

many financing choices available to his clients because of his experience with numerous lenders,

including A lenders, B lenders, and private lenders.

He has helped numerous clients acquire mortgage loans for their dream houses, investment

properties, and business endeavours as a successful mortgage broker. Because of his kind

demeanour and ability to explain complex mortgage concepts in simple terms, Anjan is well-liked

by clients.

He spends time learning about the particular requirements and objectives of each client before

putting in an unceasing effort to identify the best financing choices to suit those requirements.

Anjan has a loyal following thanks to his commitment to his clientele and a lot of repeat business.

Even after the mortgage transaction is complete, he takes pride in forging close bonds with each

of his clients and is always willing to offer guidance or answer questions.

In addition to his knowledge of the mortgage sector, Anjan is a devoted local resident. He is

committed to giving back and donates his time and money to assist regional non-profits and

charities.

Anjan Ghosh is a reputable mortgage broker who has helped a great number of Canadians realize

their financial goals and aspirations of homeownership. Anyone looking for knowledgeable

mortgage advice and individualized service should consider him because of his experience,

knowledge, and approachable demeanour.

Mortgage Guidance That Feels Like Home

From first questions to final decisions, we're here to help you find the mortgage that feels right for you.

Buying Your First Home

Buying your first home should feel exciting, not overwhelming. I’ll guide you through every step, explain your options clearly, and help you secure a mortgage that fits your life, your budget, and your future, with confidence and without pressure.

Renewing

Renewing your mortgage doesn’t have to be automatic. I’ll review your current terms, explore better options if they exist, and help you renew with clarity and confidence, making sure your mortgage still fits your life today and ahead.

Refinancing

Refinancing is about making your mortgage work harder for you. I’ll help you explore ways to lower payments, access equity, or adjust your terms: clearly, thoughtfully, and with your long-term goals in mind.

Self-Employed Mortgages

Self-employed doesn’t mean out of reach. I’ll help you navigate income complexity, find lenders who understand your situation, and secure a mortgage that reflects your true earning power: clearly, confidently, and without unnecessary stress.

Debt Consolidation

Debt consolidation can create breathing room. I’ll help you combine higher-interest debts into a simpler mortgage solution, reduce monthly strain, and bring clarity back to your finances, so you can move forward with confidence.

New To Canada

New to Canada and ready to buy? I’ll help you understand your options, work with lenders who support newcomers, and guide you through the process step by step, making your path to homeownership clear, welcoming, and achievable.

Vacation Properties

Thinking about a vacation property? I’ll help you understand financing options for cottages and second homes, plan smartly for the long term, and secure a mortgage that supports your lifestyle, without turning the dream into stress.

Reverse Mortgages

Reverse mortgages are about choice and flexibility. I’ll help you understand how accessing home equity can support your lifestyle, answer your questions clearly, and make sure this option fits your goals, comfortably and on your terms.

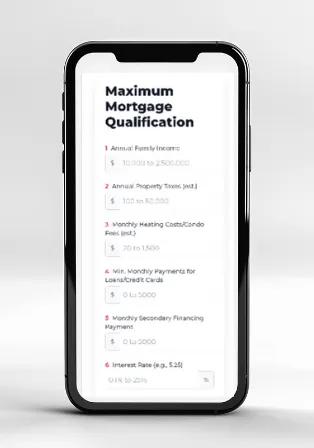

How Much Can You Afford?

Try one of the following calculators to run some scenarios. After which, we would be more than happy to assist you with any questions you may have.

Latest News

Canada Mortgage Market Update: Affordability Gains, Construction Trends and Market Activity

Canada’s mortgage and housing landscape is showing mixed signals as the year draws to a close. Recent data point to modest improvements in home affordability, a stronger housing starts report, and ong... ...more

Mortgage Market Update

December 29, 2025•3 min read

Canada Mortgage Market Update: Delinquency Trends, Housing Starts and Household Debt

Canada’s mortgage market is navigating a period of mixed signals. Recent data show a national decrease in mortgage delinquencies, a surge in housing starts in November, and a rise in household debt re... ...more

Mortgage Market Update

December 15, 2025•3 min read

What Canada’s current mortgage climate means for borrowers and lenders

What Canada’s current mortgage climate means for borrowers and lenders ...more

Interest Rates

December 08, 2025•3 min read

Frequently Asked Questions

What's the best mortgage rate I can get?

Consumers increasingly begin their mortgage search by asking about the best rate available and that’s understandable. Interest rates vary based on your financial profile (credit score, income, down payment), the type of mortgage you choose (fixed vs. variable), and the lender you work with.

There isn’t one “best” rate for everyone. The lowest advertised rate might be tied to products with restrictions or penalties. What matters most is what rate you personally qualify for and how it fits with your goals. A mortgage professional can help you compare multiple lenders to find the most appropriate rate for you.

How much down payment do I actually need?

Down payment requirements in Canada are standardized based on the price of the home:

5% of the first $500,000

10% of the portion between $500,000–$1,499,999

20% for homes $1,500,000 and up

Example:

If a home is $750,000, the minimum down payment is:

5% of the first $500,000 = $25,000

10% of the remaining $250,000 = $25,000

Total minimum = $50,000

If your down payment is less than 20%, you’ll need mortgage default insurance (through CMHC or private insurers), which protects the lender, but allows you to buy sooner.

How much house can I afford or how much mortgage will I get approved for?

Lenders in Canada assess affordability by looking at:

Your income and employment stability

Your debt obligations

Your credit history

Your down payment amount

Your total monthly housing costs relative to income

These factors feed into ratios like the Gross Debt Service (GDS) and Total Debt Service (TDS). These guidelines help determine how much mortgage you’re likely to be approved for.

Getting pre-approved with a lender gives you a solid number to work with before you start house hunting.

Should I choose a fixed or variable rate mortgage?

This is a very common question for borrowers.

Fixed rate means your interest rate stays the same for your term. It offers predictability — great if stability is important to you.

Variable rate may start lower, but it can change with market conditions. That can mean savings if rates fall — or higher costs if rates rise.

Both have advantages and trade-offs. There’s no universal right answer. It depends on your comfort with risk, your financial plan, and views on the interest-rate environment.

A mortgage professional can help you weigh which option aligns best with your goals.

Follow Us

Follow Us

© Copyright 2026. Haystax Financial. All rights reserved.